Advanced & Big Data Analytics

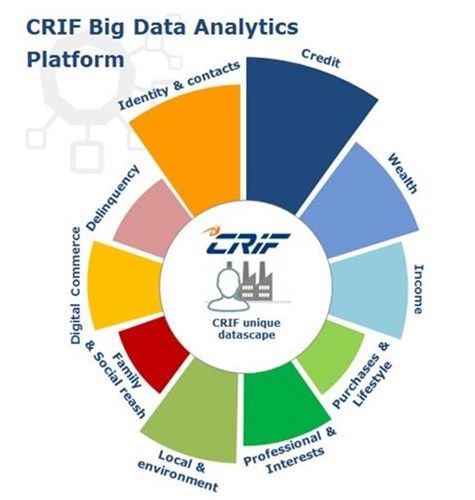

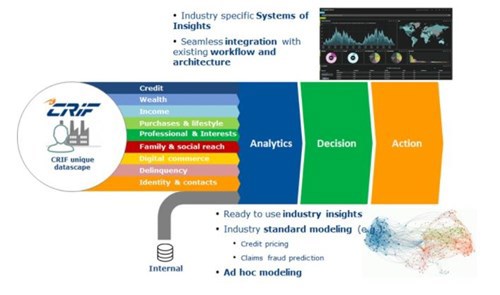

CRIF’s Enterprise APPs enable business users to easily leverage big data and advanced analytics to change everyday decisions and boost business performances in Sales & Marketing, Credit and Operations. CRIF enables businesses competing in the information era to reduce costs and lift revenues by using industry specific enterprise APPs based on its Advanced & Big Data Analytics Platform. Each APP is a full blown solution from data to predictive analytics to decisioning of a specific business issue that CRIF tackles providing configurable software products and consultancy to create an industrialized solution integrated with legacy and operational systems.

Having over 25 years of experience in Predictive Analytics and Big Data with customers in 50 countries, CRIF has developed best practices for decision management that help our clients maximizing benefits from insights and decision support solutions.

Advanced & Big Data Analytics: the CRIF difference

A unique view of individuals and markets: